When they you should never, the borrowed funds amount is regarded as a shipping, subjected to tax and you will a 10% penalty if your debtor is lower than 59 . 5.

Really 401k arrangements and additionally allow for difficulty withdrawals, that are not paid down. For every single package trustee set its qualification criteria, along with a certain definition of hardship you to members need to satisfy. Individuals who just take a hardship exception are generally banned out of adding on their policy for about six months, must pay taxation into the matter withdrawn, together with a good 10% punishment in the event the around ages 59 . 5 unless the latest debtor meets rigorous certification to own an exception to this rule.

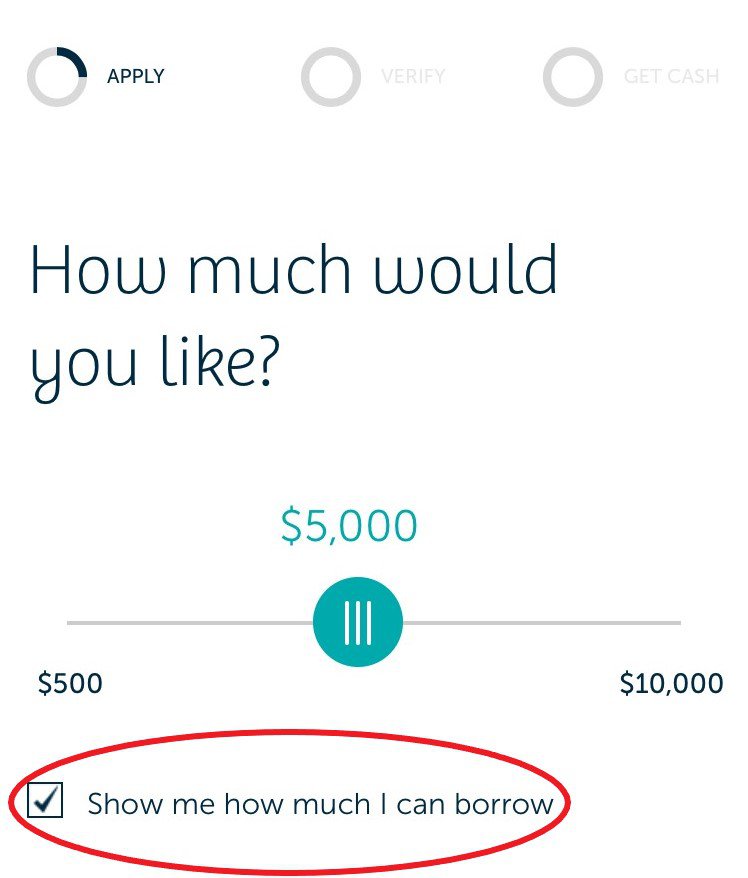

Private later years levels (IRAs) don’t allow funds, but they do create withdrawals. Currency contributed to Roth IRAs try taxed in route into the, so it would be taken instead of punishment. Although this might seem instance an enticing option, the federal government caps IRA benefits at $5,five hundred a-year-otherwise $six,five hundred for people fifty and over-therefore withdrawn financing can’t ever be totally rejuvenated. Immediately after referring away, it’s a single-way pass, McBride told you.

Looking beyond loans

Although package users pull out loans to settle costs, there are many an easy way to tackle including personal debt. Non-money borrowing from the bank guidance businesses will help people run loan providers to help you present a repayment package very often lowers the eye prices with the the newest affected profile, told you Bruce McClary, loans with bad credit in Elim spokesperson for the National Basis to own Borrowing Guidance. (Note: such low-winnings try separate regarding getting-cash debt relief providers one to obtain through the post.)

McClary remembers you to client he previously when he worked for a great credit-counseling institution. A female inside her later 30s otherwise very early 40s, she got a healthcare disaster you to contributed to $40,000 in debt. Because of the that time within her career, she had and additionally amassed a considerable advancing years membership. She don’t need certainly to touch one 401k, McClary said. She was adamant about this.

Of several medical providers should determine commission arrangements having customers instead billing people attract otherwise punishment. Yet the female’s obligations had already moved towards the stuff, very she didn’t have a choice of functioning really together doctor or hospital. McClary helped the woman and her financial institutions create a decide to pay the girl expenses.

Yes, lifestyle changes commonly as easy as scraping a beneficial 401k, but they can help to save beloved senior years finance. You do not including food cooked kidney beans and you can shredded wheat getting six months, but that will be what it takes, Smith said.

Smith’s variety of appropriate reasons to capture an effective 401k financing was short: to pay back taxation or any other money owed towards the Internal revenue service, to blow an income tax lien, or even to stay away from personal bankruptcy. (In the event you cannot end bankruptcy proceeding, old-age property are usually protected in procedure.)

Someone facing large expenses may get an associate-time business and you can/otherwise tense their straps to create more money, said Andy Smith, an official financial planner and you can co-machine of Common Financing Reveal

Most other experts provides a greater thoughts. In the event that a participant takes financing after and you can repays they, it is far from like a challenge, told you Robyn Credico, laid out sum routine chief, United states, during the Systems Watson. This is the of those who use the 401k since a bank account who’re problematic.

In reality, the original 401k loan can be act as a gateway so you’re able to serial borrowing, predicated on Fidelity. A huge-size Fidelity study from 401k investors a year ago signifies that one to of several earliest-date 401k individuals went on when deciding to take even more finance.

Financing getting house instructions discovered advantageous treatment lower than certain agreements, with a beneficial 10-season schedule to own repayment instead of just five. As the tempting as it can end up being to help you acquire getting a lower payment, which extension only prolongs losing compound progress and should be prevented if at all possible, benefits say.

Deja tu comentario