Similar to VILLAIN loans. Some tips about what You will want to Look out for-They’re going to Sometimes Impede Your own Deal, Destroy Your own Price or Bad…

I really like the fresh new character, right? I consider a royal prince operating towards the fray preserving the brand new damsel inside the worry. Not? Whenever i very first heard of Character loans, I relevant my eyes out of a champion with Hero while the I’m sure it desired me to. But they are from Champion funds he’s a lot more like VILLIAN loans ebony, questionable letters waiting to bargain from the pouches, blow up your loan, or even worse, leave you eliminate several thousand dollars.

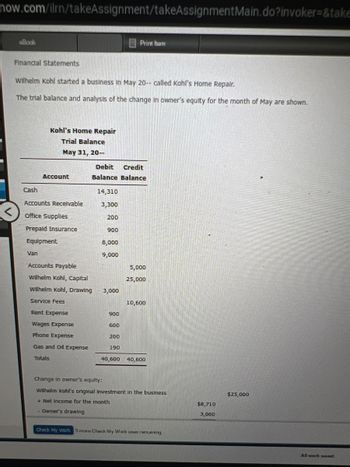

Underneath the Taxation Exceptions part of the PTR a hero mortgage would-be noted

Simply dos regarding the post we’re going to tell you a genuine-life Champion financing and scenario and you can what you might choose to do in order to manage oneself and you will/otherwise their individuals from the villains.

Hero stands for Household Time Restoration Possibility (HERO). It belongs to the house or property Assesed Clean Time Program (PACE) system which provides financial support having opportunity-effective, renewable energy factors so you can organizations typically. Discover graph below where states.

In the most common states, Hero loans try awarded because of the state thread statutes. How much does that mean? Simply speaking and you may simplified terminology, it indicates these fund have the same priority just like the possessions income tax- es. This means that he could be banks checking account for bad credit superior to the fresh liens issued of the mortgage lenders. Therefore, incapacity to blow these liens leaves all the liens junior on them (the actual money regularly ac- quire the fresh characteristics in most circumstances) on the line.

In Selling Book approved , Federal national mortgage association says that it will perhaps not purchase any Rate loan that will not using in order to their loan. Freddie Mac says the same thing. As all finance are pre-sold to help you Fannie mae prior to lender money, so it effectively slams the entranceway to the old-fashioned investment to own Hero money instead of for example sandwich- ordination. FHA does not want to fund also rather than sandwich- ordination.

We shall discuss Champion/Rate financing in detail, exactly why are them constitutional, the way they was set-up, exacltly what the threats could well be, and you will what’s happening online

Sure, there are specifications and you may feature getting Champion financing to-be subordinated and thus enable it to be a GSE lien to be in lay. But not, since the latest given that a year ago there were problems with Federal national mortgage association and you will Freddie Mac accepting HERO’s subordination vocabulary.

No matter, there can be one chill on transformation procedure of an excellent house. Representatives can expect a longer DOM to have property due to brand new Champion financing. Then, because GSEs dont al- lower HEROs included in Examination, they have to be included in the CLTV of the home.

In which can a purchaser change? In which can also be a debtor change? Maybe so you can alternative low-financial loan providers or individual currency lenders. Although not, to own an effective LO who would like to intimate a loan, so it effectively will get a frustration and a possible low-beginner for them. Best case circumstances there are many more hoops so you’re able to plunge by way of to possess the brand new borrower to close off their financing.

step one. Obtain the PSA / Application for the loan and view In the event that a champion are Announced. Appears visible. Opinion the purchase arrangement otherwise application for the loan to check out in the event that an effective Character was unveiled throughout the arrangement. Whether or not it was not, then you certainly still have to take a look at another place, however, at the least you may have an indicator that you can maybe not be on around.

Rating an effective PTR as fast as possible and you will opinion they. In the Ca, by way of example, the term of Hero mortgage usually try Notice regarding Assessment and you can Commission off Contractual Assessment Expected. It may be named something else entirely and will typically getting best ahead of, at the, or after new special assessments revelation regarding PTR. When it is there, you then discover you really have a character you will want to place!

Deja tu comentario